Service.

Experience.

Compassion.

SCS Trust Services offers self-settled and third-party pooled and individual trust administration, specifically tailored to meet the unique needs of each client.

Types of Trust We Administer

Pooled Trusts

Pooled Trusts are a means to provide the benefits of a special needs trust, without having to set up and administer a separate trust.

A pooled trust is managed by a non for profit organization. The assets of each member in the pooled trust are pooled together for investment purposes, thereby allowing for more stable investments and a more streamlined approach to administering the trust disbursements. SCS Trust Services supports individuals in the administration of 1st & 3rd party pooled trusts.

01

Why should I join a Pooled Trust?

Under current New York Medicaid law, income in excess of the monthly Medicaid allowance must first be spent down on home care or medical expenses prior to receiving Medicaid coverage. Unfortunately, the guidelines do not exempt living expenses, such as rent, food, clothes, or utility services when calculating an applicant's excess income. As a result, Medicaid recipients may not have a sufficient amount of funds to maintain their standard monthly living expenses.

02

What are the terms of eligibility?

Trust accounts must be established for the sole benefit of the disabled beneficiary.

The beneficiary or authorized representative must submit a completed and signed joinder agreement. You can request information or a joinder agreement by calling.

A beneficiary must be disabled as defined by law.

Income deposited to the trust account must belong to the beneficiary.

03

How do I join SCS Pooled Trust?

In order to join our Pooled Trust the beneficiary or authorized representative must submit a completed and signed Joinder Agreement. For information on how to receive an application or

for assistance in applying online please reach out to our office at

800-540-6732 or by emailing info@scstrusts.org

Individual Special Needs Trust

SCS Trust Services administers 1st & 3rd party Individual special need trusts.

Unlike a Pooled trust, an individual special needs trust is created for a specific individual with a disability. Individual special needs trusts can be administered by a family member, friend, or SCS Trust Services.

1st Party Trust vs. 3rd Party Trust

1st Party

Protect the Assets of an individual with a disability

Can only be established and funded by the disabled individual, their POA, or Guardian

Subject to the Medicaid Payback

3rd Party

Protects the existing or future benefits of a person with a disability

Can be funded by a parent, grandparent, or a family member of a disabled individuals

Not subject to the Medicaid Payback

Why Choose

SCS Trust Services?

No Minimum Deposit Requirement

No minimum or Hidden Fees

Dedicated & Knowledgeable Case Manager

No Minimum Balance Requirement

Benefits of SCS Trust Services

Efficient Processing

Expedient and efficient processing of all new Joinder Agreements.

Expedited Requests

Expedited processing of disbursement requests (unlimited monthly disbursements).

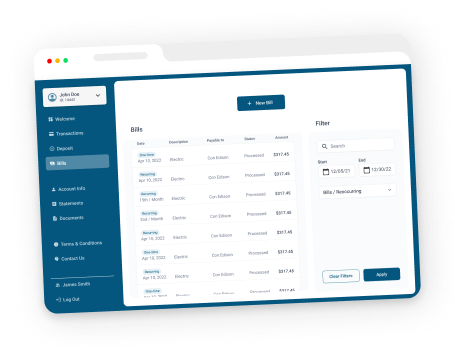

Online Account Access

Real time account access to monitor your deposits and request disbursements

Prepaid Card

Enjoy a Prepaid card tied to your account with personalized controls to ensure compliance of eligible trust disbursements.

6 Locations

States We Service

New York

New Jersey

Florida

Pennsylvania

Massachusetts

North Carolina

Forms

Please select the state in which you are applying to download the correct form.

Select State:

We'd love to hear from you

Our team is ready to answer all your questions.

Fill out the form and we’ll be in touch with you shortly.

© 2024 SCS Trust Services